Having a credit score below 620 in retirement can feel limiting — but rebuilding doesn’t require thousands of dollars or risky financial moves.

Many seniors living on Social Security or fixed income don’t want to risk large deposits or high fees. At the same time, rebuilding credit after retirement requires a tool that actually reports to credit bureaus and improves your profile over time.

That’s where $200 secured credit cards come in.

In 2026, a $200 deposit remains the most common entry point for secured credit cards for seniors. It’s financially manageable, low risk, and often enough to restart positive credit history.

This guide explains:

- Why $200 secured cards matter

- What features actually matter

- Realistic card structures available in 2026

- How to use a $200 limit without hurting your score

- When $200 may not be enough

The goal is clarity — not hype.

Why $200 Secured Cards Matter for Seniors in 2026

For retirees, capital preservation matters.

A $200 deposit is accessible without jeopardizing emergency savings. It allows seniors to begin rebuilding credit without overcommitting limited funds.

Low Financial Risk

Unlike unsecured cards, your exposure is capped at the deposit amount. If managed properly, the risk is controlled and predictable.

Ideal for Gradual Credit Rebuilding

Credit rebuilding after retirement is not about speed. It’s about consistency.

A $200 secured card creates structure. Used properly, it strengthens payment history and utilization metrics.

Alignment with Fixed Income

Many retirees prefer not to tie up $500–$1,000 in deposits. A $200 entry point balances accessibility and strategy.

If you want a broader understanding of how these cards function overall, review our full breakdown in Secured Credit Cards for Seniors (2026 Complete Guide).

Why $200 Became the Standard Entry Deposit in the Market

The $200 minimum deposit is not random. It became the industry norm because it balances accessibility with meaningful credit reporting impact.

For issuers, $200 provides enough collateral to justify approval for applicants with lower scores. For seniors, it keeps the financial commitment manageable without tying up excessive funds.

Lower deposits (such as $49 or $99 promotional offers sometimes advertised) often come with:

- Higher fees

- Reduced flexibility

- Lower long-term graduation potential

In practice, $200 creates enough credit capacity for scoring models to track utilization behavior effectively.

This is why most reputable secured credit cards for seniors still use $200 as the baseline in 2026.

What to Look for in a $200 Secured Credit Card

Not all $200 secured cards are equal.

Here’s what actually matters.

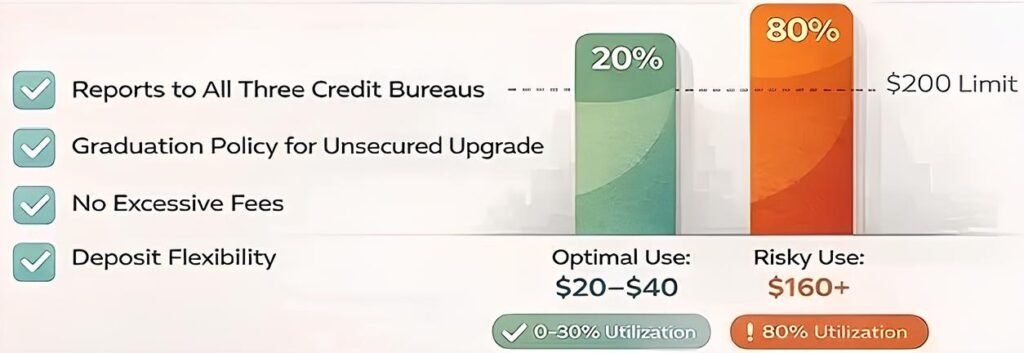

Reports to All Three Credit Bureaus

This is non-negotiable.

If the card does not report to all three major bureaus, it will not maximize credit rebuilding.

No Excessive Processing Fees

A $200 deposit should remain your money.

Be cautious of cards charging:

- $75–$100 processing fees

- Monthly maintenance fees

- Hidden activation charges

A deposit is refundable. A processing fee is not.

Graduation Policy

Does the issuer review accounts for upgrade to unsecured status after 6–12 months?

A clear graduation policy signals long-term viability.

Reasonable APR Structure

APR matters less if you pay in full monthly — which you should.

However, extremely high rates signal risk and poor card structure.

Deposit Flexibility

Can you increase your limit later by adding funds?

Some cards allow you to move from $200 to $300–$500 without reapplying. That flexibility can reduce utilization and improve scoring.

3 Realistic Secured Card Structures with $200 Deposit (2026)

These are educational examples of card categories — not affiliate reviews.

Card Type 1 – No Annual Fee Secured Card

- Minimum Deposit: $200

- Annual Fee: $0

- Reports to Bureaus: Yes

- Graduation: After 6–12 months (issuer review)

- Best For: Seniors seeking lowest cost structure

This type is often ideal for retirees rebuilding cautiously.

Card Type 2 – Low Annual Fee with Flexible Deposit Increase

- Minimum Deposit: $200

- Annual Fee: $25–$39

- Reports to Bureaus: Yes

- Graduation: Possible but not guaranteed

- Best For: Seniors who may increase limit later

This structure offers flexibility but requires fee awareness.

Card Type 3 – No Credit Check Secured Model

- Minimum Deposit: $200

- Annual Fee: Varies

- Reports to Bureaus: Yes

- Graduation: Limited

- Best For: Seniors recently denied unsecured cards

Approval probability is high, but fees must be reviewed carefully.

Comparison Table

| Card Type | Annual Fee | Graduation Policy | Best For | Risk Level |

|---|---|---|---|---|

| No Fee Secured | $0 | 6–12 month review | Cost-conscious seniors | Low |

| Low-Fee Flexible | $25–$39 | Conditional | Seniors increasing limit later | Moderate |

| No Credit Check | Varies | Limited | Recent denials | Moderate |

Approval Odds for Seniors Using Social Security Income

Many retirees worry that fixed income reduces approval chances.

In most cases, Social Security income qualifies as legitimate income.

Issuers evaluate:

- Income stability

- Identity verification

- Banking history (ChexSystems in some cases)

What Is ChexSystems?

ChexSystems tracks banking activity, not credit scores.

Recent overdrafts, unpaid bank fees, or account closures could affect approval with certain issuers.

When Approval May Fail

- Unresolved identity issues

- Fraud alerts

- Active bankruptcies

- Deposit payment failures

If you’re unsure where you stand, you may also want to review Best Credit Cards for Seniors with Bad Credit (2026) for broader strategy guidance.

You can review your official credit reports for free once per year at AnnualCreditReport.com, the only federally authorized source under U.S. law.

How Underwriting Models View Retirees in 2026

Modern credit underwriting is algorithm-driven.

Lenders evaluate:

- Income stability

- Debt-to-income ratio

- Recent payment behavior

- Existing credit utilization

Retirement itself is not negative. In fact, consistent Social Security income is often viewed as stable.

What can impact approval more significantly is recent activity such as:

- Multiple hard inquiries

- Recently opened accounts

- Recent missed payments

For seniors, the strongest approval strategy is simplicity:

One application

One deposit

One well-managed account

Underwriting systems reward predictability more than income size.

How to Use a $200 Limit Without Hurting Your Score

A $200 limit requires discipline

Ideal Spending Range

To protect your score:

- Spend between $20 and $60 monthly

- Stay below 30% utilization

- Ideally remain under 20%

Spending $180 on a $200 limit signals high risk to scoring models.

Why Maxing Out Hurts

Utilization accounts for roughly 30% of your credit score.

Even if you pay in full, high reported balances can temporarily reduce your score.

Autopay Strategy

Set autopay for:

- Full statement balance

- At least minimum payment backup

Automation protects consistency.

Timeline Expectations

- 3 months: Early score movement

- 6 months: Measurable stabilization

- 12 months: Strong case for graduation

If you want alternatives after improvement, explore Top 5 No-Annual-Fee Cards to Rebuild Your Credit Score Fast.

How a $200 Card Impacts Your Credit Mix

Credit mix accounts for a smaller percentage of your score, but it still plays a role.

If a senior’s credit report currently shows:

- Only installment loans (like auto loans)

- Or mostly closed accounts

Adding a revolving account (such as a secured credit card) improves scoring diversity.

Revolving credit demonstrates ongoing management behavior.

Even a small $200 limit can:

- Reactivate dormant credit profiles

- Improve utilization metrics

- Strengthen scoring categories simultaneously

This is why secured credit cards for seniors are often recommended even when balances are modest.

When a $200 Secured Card Is NOT Enough

Sometimes $200 is too restrictive.

High Utilization Problem

If your monthly recurring expenses exceed $60–$80, utilization may stay too high.

In that case, consider:

- Depositing $300–$500 instead

- Or waiting to apply until savings allow higher deposit

When to Wait Before Applying

If you recently missed payments or opened multiple accounts, waiting 60–90 days may improve approval odds.

Structure beats urgency.

When Increasing the Deposit Is a Strategic Advantage

While $200 is accessible, it is not always optimal.

If your typical monthly spending on recurring bills — such as utilities, subscriptions, or insurance — exceeds $60–$80, maintaining utilization below 30% becomes difficult.

For example:

- $200 limit → $80 spending = 40% utilization

- $400 limit → $80 spending = 20% utilization

Same behavior. Different scoring impact.

Because the deposit is refundable, increasing it does not increase financial risk — it simply improves your utilization ratio flexibility.

For seniors who can comfortably afford it, a $300–$500 deposit often accelerates score stabilization without increasing debt exposure.

The key principle:

Match your deposit size to your realistic monthly spending pattern.

That creates sustainable credit rebuilding instead of constant utilization pressure.

Common Mistakes Seniors Make with Small-Limit Secured Cards

Using 90% of the Limit

This damages utilization ratios.

Applying for Two Secured Cards

One well-managed card is enough.

Closing Too Soon

Account age strengthens your profile.

Ignoring Fees

Annual and monthly fees reduce the benefit of rebuilding.

When a $200 Deposit May Be Strategically Too Low

While $200 is accessible, it can create a utilization constraint.

Example:

If you spend $100 monthly on recurring bills, that equals 50% utilization on a $200 limit — too high for optimal scoring.

In these situations, depositing $300–$500 can:

- Lower utilization percentage

- Improve score impact

- Reduce financial stress

The deposit should match your realistic monthly spending, not just the minimum requirement.

For many seniors, a slightly higher deposit accelerates stabilization without increasing risk — since it remains refundable.

Frequently Asked Questions

Can you get a secured card with only Social Security income?

Yes. Social Security is considered valid income by most issuers.

Does a $200 limit help rebuild credit?

Yes — if used below 30% utilization and paid on time consistently.

How long should seniors keep a secured card?

At least 6–12 months. Often longer if it supports account age.

Will the deposit be refunded?

Yes, if the account is closed in good standing or upgraded to unsecured status.

A 12-Month Credit Progression Strategy

If rebuilding is your goal, think in phases.

Months 1–3: Establish Control

Open one secured card. Keep utilization below 20%. Set up autopay.

Months 4–6: Stabilize Behavior

Maintain perfect payment history. Avoid new credit applications.

Months 7–9: Evaluate Growth

If your score improves toward the mid-600s, consider whether a deposit increase or graduation review makes sense.

Months 10–12: Transition Carefully

If eligible, transition to a low-fee unsecured card. Keep the secured account open if it supports account age.

Measured growth reduces volatility in your score and builds long-term stability.

Final Strategic Perspective

A $200 secured card is not a long-term solution.

It is a structured entry point.

For seniors rebuilding credit, the path is:

Start small → Use responsibly → Graduate → Strengthen profile.

Rebuilding credit in retirement is realistic.

But it requires patience and disciplined execution.

Structure always outperforms speed.