If your credit score is below 620, applying for a traditional credit card can feel discouraging.

Retirement often brings income changes, medical expenses, or temporary financial setbacks that affect credit history.

The good news is this: secured credit cards for seniors are not “last-resort traps.”

When used strategically, they are one of the most effective tools for credit rebuilding after retirement.

In this complete 2026 guide, you’ll learn how secured cards work, when they make sense, how approval typically happens, and how to upgrade responsibly.

The goal isn’t speed — it’s structure.

What Is a Secured Credit Card?

A secured credit card is a standard credit card backed by a refundable security deposit.

You deposit money — usually between $200 and $500 — and that amount becomes your credit limit.

If you deposit $300, your credit limit is typically $300.

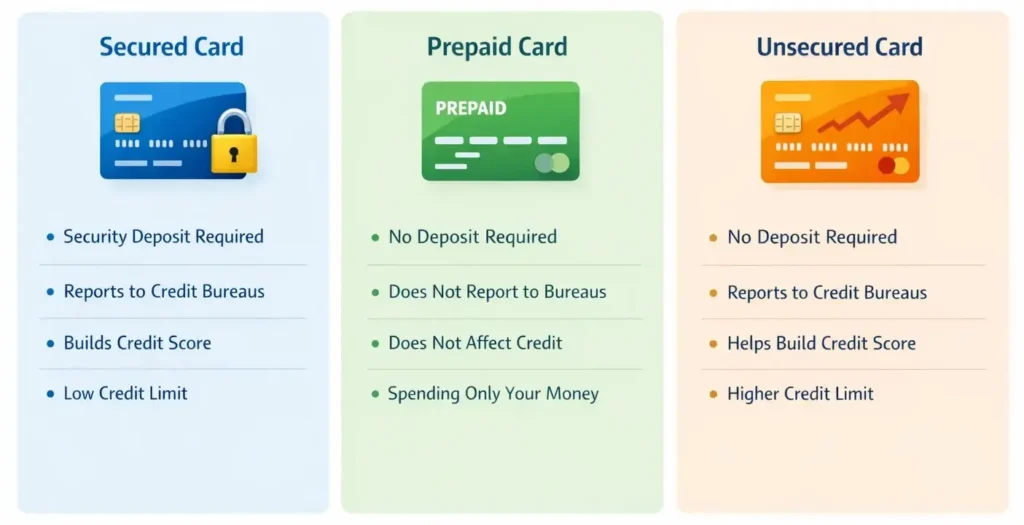

The key difference from a prepaid card is important:

- Secured card: Reports to credit bureaus and builds credit

- Prepaid card: Does not report and does not build credit

This distinction matters especially for seniors.

If you are rebuilding credit after retirement, only a card that reports activity to major credit bureaus will improve your score.

Secured cards are often called security deposit credit cards for seniors because they reduce risk for the issuer while giving you access to traditional credit behavior.

Secured vs Prepaid vs Unsecured Cards (2026)

Why Secured Credit Cards Work Well for Seniors

Secured cards align well with retirement realities.

1️⃣ Stable Income Source

Many retirees rely on Social Security, pensions, or retirement distributions.

Lenders view consistent income — even if modest — as predictable.

2️⃣ Built-In Spending Control

Because your credit limit matches your deposit, overspending becomes harder.

This naturally reduces risk.

3️⃣ Predictability

There are no surprise credit limit decisions at approval.

You control the starting limit.

4️⃣ Lower Risk for the Issuer

The deposit offsets potential losses, making approval far more likely for applicants with lower scores.

For seniors starting credit rebuilding after retirement, secured cards are often the most reliable first step.

If you’re still deciding which direction to take, you may want to review our broader comparison in Best Credit Cards for Seniors with Bad Credit for additional context.

How the Security Deposit Works

Most secured cards require a minimum deposit between $200 and $500.

Here’s how it functions:

- The deposit is refundable

- It is not a fee

- It remains your money

You receive it back when:

- You close the account in good standing

- Or the card upgrades to unsecured status

If you close the account with an unpaid balance, the deposit may be applied toward what you owe.

It’s important to distinguish deposit from fees.

Some issuers charge:

- Annual fees

- Processing fees

- Monthly maintenance fees

Excessive upfront processing fees are red flags.

A legitimate secured card should not require large non-refundable setup charges.

Deposit Sizes, Credit Limits, and Increasing Your Limit

Most seniors start with a $200–$500 deposit, but some issuers allow higher deposits that create a higher starting limit. If you can comfortably afford it, a slightly higher limit can help keep utilization low without changing your spending habits.

For example, a $200 limit makes it easier to accidentally cross 30% utilization with routine purchases. A $500 limit gives more breathing room while you build on-time payment history.

Some issuers also allow you to increase your deposit later to raise your credit limit. If you choose this route, treat it as a credit-building tool — not as permission to spend more. The goal is controlled usage with consistent payments, which is exactly why secured credit cards for seniors are so effective for rebuilding.

Approval Requirements in 2026

One reason secured cards for retirees remain popular is accessibility.

Credit Score

Minimum score requirements are often flexible.

Many issuers accept scores below 600.

Income Verification

Social Security income is valid and acceptable.

Stability matters more than size.

ChexSystems Screening

Some issuers review ChexSystems, which tracks banking history.

Past overdrafts or account closures could affect approval.

Situations That May Cause Denial

- Active fraud alerts

- Recent bankruptcies still in processing

- Unresolved identity verification issues

In most cases, when deposit funds are available and identity is verified, approval odds are high.

For additional pathways, you can also explore 3 Secured Credit Cards That Don’t Require a Credit Check to understand alternative approval models.

How Secured Cards Rebuild Credit (Mechanics Explained)

Understanding how secured cards improve your score gives you control.

Payment History (35%)

This is the largest scoring factor.

On-time payments every month build credibility.

One late payment can undo months of progress.

Credit Utilization (30%)

Utilization refers to how much of your credit limit you use.

If your limit is $300:

- Spending $30 (10%) is excellent

- Spending $270 (90%) hurts your score

Keep usage below 30%, ideally below 20%.

Account Age

The longer the account stays open and positive, the stronger your credit profile becomes.

Closing secured accounts too quickly can shorten average account age.

Hard Inquiries

Applying for multiple cards creates hard inquiries.

Too many inquiries reduce your score temporarily.

Realistic Timeline

- 3 months: Initial score movement possible

- 6 months: Noticeable improvement if usage is consistent

- 12 months: Strong foundation for upgrade eligibility

Secured cards are not instant fixes.

They are structured rebuilding tools.

If your goal includes avoiding fees while rebuilding, also review Top 5 No-Annual-Fee Cards to Rebuild Your Credit Score Fast.

The “Graduation” Process: How Seniors Upgrade from Secured to Unsecured

Many secured cards include a graduation path — meaning the issuer may upgrade you to an unsecured card after a track record of responsible use. In 2026, the most common upgrade window is 6 to 12 months, but it varies by issuer and your credit behavior.

Graduation typically depends on three signals:

- On-time payments every month

- Low utilization (below 30%, ideally below 20%)

- No recent negative marks on your credit reports

If you’re upgraded, the deposit is usually returned (often by check or as a statement credit). Some issuers automatically review accounts, while others require you to request consideration.

One important caution for retirees: don’t close the secured account immediately after graduation unless the issuer converts the same account to unsecured status. Keeping account age intact can help your score remain stable as you move into stronger products.

When Should a Senior Upgrade to an Unsecured Card?

Upgrading too early is a common mistake.

Generally, consider upgrading when:

- Score reaches 640–660

- No late payments for 6–12 months

- Utilization remains low

Some issuers automatically review accounts for graduation.

Important:

Do not close your secured card immediately after upgrading.

Maintaining account age supports your score.

Common Mistakes Seniors Make with Secured Cards

Using 100% of the Limit

Maxing out your card signals risk.

Closing the Account Too Soon

Length of credit history matters.

Applying for Multiple Secured Cards

One well-managed card is sufficient.

Ignoring Fees

Always review annual and maintenance fees.

Confusing Secured with Prepaid

Prepaid cards do not build credit.

Structure matters more than speed.

A 12-Month Credit Rebuilding Roadmap for Seniors

If you want predictable improvement, treat rebuilding like a plan.

Months 1–3: Stabilize

Use one secured card, keep utilization low, and set autopay. Avoid new credit applications.

Months 4–6: Strengthen

Keep balances consistently under 30%, ideally under 20%. Pay in full when possible. Monitor your reports for errors or newly reported collections.

Months 7–9: Prepare for Better Approval

If your score rises toward the mid-600s, you may be ready to consider an upgrade or a low-limit unsecured product. Keep inquiries minimal and avoid retail store cards with extreme APR.

Months 10–12: Expand Carefully

If your profile stabilizes, you can evaluate lower-interest options. The objective is not more credit — it’s better credit terms and long-term stability.

Rebuilding credit after retirement is not rare. It’s common when the process is structured, consistent, and patient.

Credit Rebuilding Timeline For Seniors 2026

Secured vs. Unsecured: Which Is Better for You?

| Feature | Secured | Unsecured (Fair Credit) |

|---|---|---|

| Deposit Required | Yes | No |

| Approval Odds | High | Moderate |

| Credit Limit | Low | Low–Moderate |

| Risk Level | Lower | Higher |

For seniors below 620, secured is usually the safer entry point.

For scores above 660, unsecured options may become realistic.

How to Apply Safely (Step-by-Step)

Step 1: Check Your Credit Report

Visit AnnualCreditReport.com to review your reports from all three bureaus.

Correct errors before applying.

Step 2: Choose One Issuer Only

Avoid multiple applications.

Step 3: Prepare Your Deposit

Ensure deposit funds are available and separate from emergency savings.

Step 4: Set Up Autopay Immediately

Automatic payments prevent missed due dates.

Consistency builds credit.

Automation protects it.

Frequently Asked Questions

Do secured cards hurt your credit?

No. When used responsibly, they improve credit.

How long should you keep a secured card?

At least 6–12 months, often longer if it supports account age.

Can you get a secured card with only Social Security income?

Yes. Social Security qualifies as legitimate income for most issuers.

Strategic Perspective

Secured credit cards for seniors are tools — not permanent solutions.

They create structure.

They reduce lender risk.

They allow controlled rebuilding.

Credit rebuilding in retirement is realistic.

But it requires discipline and patience.

If your score is below 620, secured cards are often the most stable foundation.

From there, you can progress to unsecured products and stronger profiles over time.

In retirement, financial stability is built step by step — not through shortcuts, but through informed decisions.